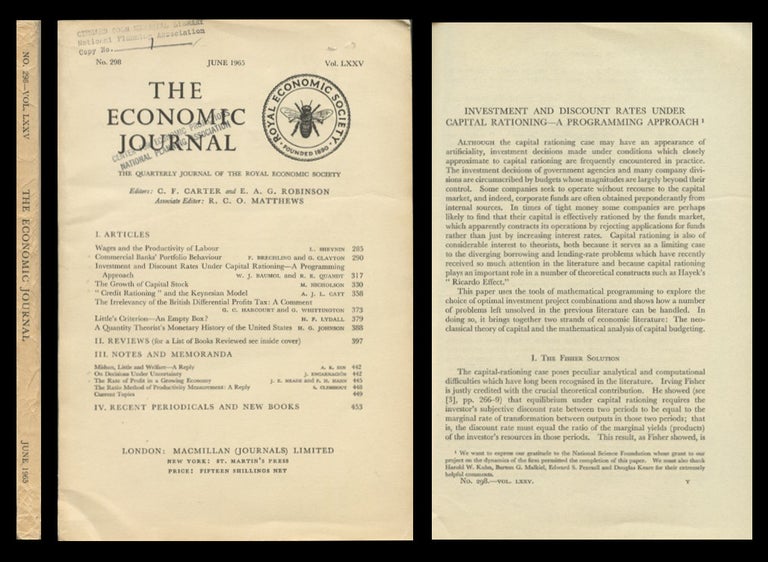

Investment and Discount Rates Under Capital Budgeting – A Programming Approach in The Economic Journal 75, No. 298, June 1965, pp. 317-329

London: Macmillan Limited, 1965. 1st Edition. FIRST EDITION IN ORIGINAL WRAPS OF A “CLASSIC” PAPER ON THE PROBLEM OF CAPITAL BUDGETING, THE 1965 BAUMOL-QUANDT MODEL.

Project selection is a major problem in managerial decision making. Capital budgeting problems determine which project to fund given constraints on available capital.

This much studied paper presents the Baumol-Quandt Model [also known as the Baumol and Quandt Problem]; in it Baumol and Quandt apply tools of mathematical programming to the topic of capital budgeting and present their approach for making project selections to maximize value.

Note that we separately offer a related paper that came ten years earlier, the Lorie-Savage Problem paper (“Three Problems in Capital Rationing” in The Journal of Business 28, 8, October 1955, pp. 229-240). Lorie and Savage use integer programming (Lagrangian methods in discrete optimization approach) to introduce the topic of capital budgeting and present their approach for making project selections to maximize value along with three examples to illustrate the approach.

Baumol and Quandt approach this same task using the tools of mathematical programming. They are also the “first [to] review existing investment selection models” – starting with Fisher, then moving on to Hirshleifer, Lorie and Savage, Baumol (in 1950), Chanres-Cooper-Miller, and the Weingartner Basic Horizon Model (Larson, Capital Budgeting, No. 173, January 1970, 47). Considered a key study and one of the principal capital rationing models, the Baumol-Quandt Model [also known as the Baumol and Quandt Model, points “out the limitations of…existing models in three things: (1) possibility of funds outside the firm or consumed by the stockholders; (2) possibility of funds unused today to be consumed in the future; and (3) relationship between current investment yields and availability of funds for current investments” (Islam, Corporate Governance).

Baumol and Quandt’s paper also launched “an important debate…about discounting under capital rationing. When governments, agencies and companies operate on a fixed budget set by third parties, the choice of discount rate for an investment project is a practical problem due to the influence that capital rationing has on the choice of optimal investment project combinations” (Florio, Applied Welfare Economics, 195). Item #934

CONDITION & DETAILS: London: Macmillan Limited. Complete issue in original wraps. Two light institutional stamps on the front wrap (see scans). 4to. (10 x 6.5 inches). Continuously paginated: pp. 286-491. Minor wear at the spine and rubbing at the edges of the wraps. Bright and very clean throughout. Very good condition.

Price: $400.00